CFOs (chief financial officers) decisions in allocating resources to pursue growth and in cost cutting make quantifiable differences in return on invested capital. The best CFO’s cost management style can produce 7 percentage point difference in return on invested capital – According to new Gartner Study.

Focusing on driving transformation, Analytics, planning disruption, CFOs more likely saying their cost management approach, data and analytics capabilities are strong and hopefully implementation will being positive impact on ROI.

“Company costs have increased faster than revenue since 2013, creating a profitability gap that has not been filled even as earnings have improved from their 2014 slump, The choices CFOs make about how to allocate resources to pursue growth and how to cut costs show quantifiable differences to returns on invested capital.” said Jason Boldt, director at Gartner

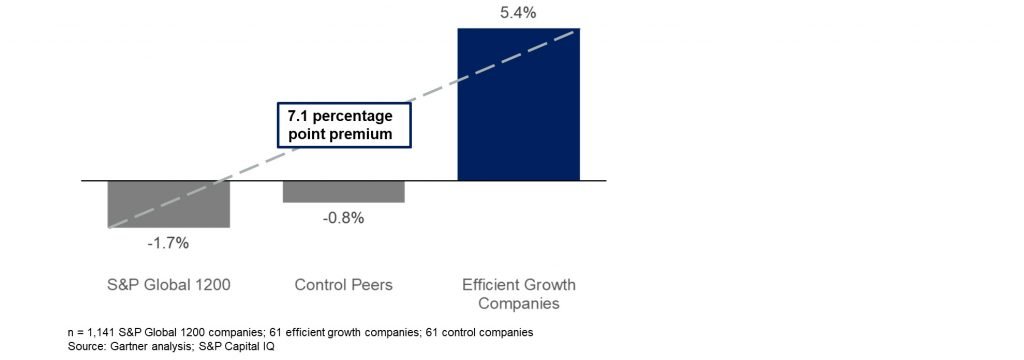

Gartner study finding shows that companies spends for revenue growth also proactivly cutting cost, an approach Gartner calls “Efficient Growth,” significantly outperformed those companies that focused on high growth or on reducing costs alone (see Figure 1).

Figure 1. Return on Invested Capital Less Cost of Capital

Average ROIC — WACC, 2010-2017

Source: Gartner (May 2019)

Cost Managing is a prevalent theme in recent earnings transcripts, and large organizations already working on cost reduction programs. In an approx 81% organization’s cost depends on the industry they are operating. Rest 19% organizations cost controlled by executive cost decision management, and this is the point where best CFOs — who deliver the best return on capital — are making their impact felt.

Four “Cost Anchors” Drag Down Earnings

Gartner Study revealed four key “cost anchors” or negative behaviors that drag down earnings, that most companies suffered from. 87% organizations suffered from poor cost visibility, 89% from cost equivalence, 84% used outdated cost models and 90% suffered from business resistance.

To overcome poor cost visibility, organization should employ multiple budget models that provide a more flexible approach for identifying good costs from bad. A mix of rolling forecast, driver-based budgeting and zero-based budgeting provides CFOs with a clearer analysis of the relationship between costs and revenue.

To overcome cost equivalence, or the perception that all costs are the same, companies should separate costs into transactional and value-add categories.

Companies can update their cost model approach by using a service-based view of costs.

Overcoming business resistance is a matter of helping business partners focus on controllable factors.

Raising “Cost Ladders” That Positively Impact Earnings

Leading cost management executives also encourage four positive cost behaviors, or “cost ladders,” that contribute to positive shareholder return. However, fewer than one in three companies Gartner studied exhibit any of these positive behaviors.

- Encouraging transformational bets: Companies with this positive cost management behavior have mapped their previous investment and clearly categorize between transformational and iterative bets. By doing this, CFOs can better decide how to allocate funds to transformational bets that will have the most impact on achieving the company’s overall investment criteria.

- Increasing cost agility: Less than one in four companiesdisplay the cost agility needed to positively impact earnings. Cost management leaders employ “proof of concept” financing that investigates uncertain variables underpinning a growth investment’s chance of success. If a proof of concept test reduces uncertainty, CFOs release full funding to complete the growth investment. This uncertainty-reduction process gives management teams an edge on competitors in taking on risky growth bets with more confidence.

- Detecting early cost warnings: Most companies don’t have a clear mechanism to flag when costs are likely to spiral out of control. Cost leaders in this area operate from a forecast model that identifies cost headwinds and tailwinds, which can be assessed on a quarterly basis, and considers factors such as foreign exchange rates; selling, general and administrative (SG&A) costs; pricing; volume; and productivity.

- Rapid reallocation from losers to winners: Reallocating funds from losing to winning projects can have a very positive effect on overall company performance, but only 15% of companies actively manage projects in a way that makes this possible. An in-progress initiative review can provide the data needed to make such decisions. Evaluating projects that are in progress, based both on current performance and leading indicator trends, can help CFOs identify opportunities to provide additional capacity and funding to projects that are outperforming.